Fed decision

Rob Tayloe discusses fixed income market conditions and offers insight for bond investors.

There has been a lot of indecision about whether the Fed will cut rates at the next meeting on December 9 and 10. The market’s anticipation about how the committee will react has driven market volatility throughout November.

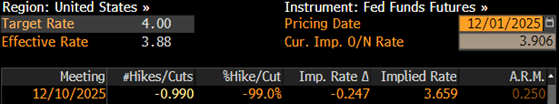

The voting members are split on whether to cut the Fed Funds rate by 25 basis points or keep it at the 3.75% to 4.00% range. However, as of this December 1 morning, the Fed Funds Futures market reflects a consumer expectation of ~ 99% likelihood that the Fed will cut the Fed Funds rate by 25 basis points. This is the highest chance that we have seen throughout November. On Monday, November 3, there was a 66% chance that rates would be cut 25 basis points. This probability dipped to 29% on Wednesday, November 19.

The Fed Funds rate is the rate at which banks charge each other for overnight borrowing. This typically only affects the very short-term part of the yield curve. However, any uncertainty will cause ripples in markets, and the swings in perception of how short-term rates will affect both stock and bond markets. There is a vast amount of money sitting in maturities under one year. ICI reports money market assets exceeding $7.5 trillion. This is a tremendous amount of money with the potential to influence rates should it shift to different parts on the maturity scale. Short-term rates have been high for a long time, enticing investors to simply roll over these funds, benefiting from rates ranging from 3.5% to 4.5%, and avoiding long-term exposure. As a matter of fact, the yield curve stayed inverted for a long period, meaning that short term yields were higher than long term yields. As the Fed continues to move toward a more neutral stance by cutting rates, short term yield advantages shrink.

As an investor, it may help to think about a long-term strategy and how to best optimize money that remains short. Although extending out on the curve increases interest rate risk, it reduces reinvestment risk. Investments positioned strategically in the steepest parts of the curve can provide added income, especially now when, by example, the corporate and municipal curves are steep and upward sloping. In other words, investors are rewarded with greater incremental yield as they extend maturities. This can prove to be a worthy long-term investment strategy and create peace of mind as investors remove exposure to volatile and declining short term rates.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.